How do Unlock Your Competitive Edge: A Deep Dive into Porter’s Five Forces

Are you trying to understand what truly drives profitability in your industry? Then you need Porter’s Five Forces one of the most influential strategy models in modern business. This powerful framework, developed by Michael E. Porter, isn’t just an academic concept. It’s a practical tool for industry analysis and spotting your next competitive advantage. Instead of only looking at direct rivals, the Five Forces help you map your entire competitive landscape so you can make smarter, faster decisions about where to play and how to win.

Want to turn insight into action?

What Is Porter’s Five Forces? (A Simple Definition)

Porter’s Five Forces is a strategic analysis framework used to evaluate the competitive intensity and long-term attractiveness of an industry.

Porter argued that competition is shaped by five structural forces, not just existing competitors:

- Competitive Rivalry

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

The stronger these forces are, the harder it is to sustain high profits. The weaker they are, the more attractive and profitable the industry tends to be.

The 5 Pillars of Analysis: Decoding the Forces

Let’s break down each of the Five Forces and why they matter for real-world strategy, especially in today’s digital and SaaS-driven markets.

1. Intensity of Competitive Rivalry

The first pillar focuses on the degree of competition among existing companies in the industry. High levels of rivalry can lead to price wars, higher marketing costs, and reduced profitability.

Key Factors:

- Number of competitors: When there are many firms of similar size, competition intensifies as each vies for market share.

- Rate of industry growth: In a slow-growing or stagnant industry, companies fight harder for a slice of the pie, increasing competition.

- Product differentiation: Undifferentiated products (commodities) lead to more competition based on price, whereas highly differentiated products lead to competition based on innovation and customer service.

- Exit barriers: When it’s difficult or expensive for companies to leave the industry, competition remains fierce even if profits decline.

Strategic Action: To handle intense rivalry, companies often focus on differentiation, creating unique value propositions that set them apart from competitors. Niche markets or innovative customer service models can also reduce direct competition.

2. Threat of New Entrants

This force analyzes how easy or difficult it is for new companies to enter the market and compete with established businesses. The threat of new entrants increases when entry barriers are low, and it decreases when entry barriers are high.

Key Barriers to Entry:

- Economies of scale: Large existing firms benefit from lower costs per unit due to their size, making it difficult for newcomers to compete on price.

- Customer loyalty: Strong brand loyalty acts as a barrier, as new entrants struggle to attract customers away from established brands.

- Capital requirements: Starting a business in certain industries (e.g., manufacturing, telecom) requires significant investment in equipment, technology, or R&D, which discourages potential entrants.

- Regulations and government policies: Licensing, patents, and legal restrictions can prevent new players from entering the market freely.

Strategic Action: To mitigate the threat of new entrants, companies can work to raise entry barriers. This could be through securing exclusive contracts, creating strong customer loyalty programs, or investing in unique technology that competitors can’t easily replicate.

3. Bargaining Power of Buyers

Buyer power refers to the influence customers have over the industry. When buyers are powerful, they can demand lower prices, higher quality, or additional services, thus eroding industry profitability.

Factors that Increase Buyer Power:

- Concentration of buyers: If a few large buyers make up a significant portion of the industry’s sales, they can exert substantial influence over pricing and terms.

- Availability of alternatives: When products are undifferentiated or easily substitutable, buyers can switch to competitors easily, increasing their bargaining power.

- Buyer switching costs: Low switching costs allow customers to change suppliers with little effort, further increasing their power.

- Volume of purchase: Large-volume buyers have more influence over the supplier, enabling them to negotiate better prices and terms.

Strategic Action: To counteract buyer power, companies can focus on increasing customer loyalty through enhanced service, differentiated products, or unique features. Additionally, long-term contracts or offering personalized experiences can reduce the likelihood of customers switching to competitors.

4. Bargaining Power of Suppliers

This force evaluates the control that suppliers have over the production process and pricing. Powerful suppliers can increase the cost of raw materials, components, or services, which negatively impacts the profitability of the companies that depend on them.

Factors that Increase Supplier Power:

- Concentration of suppliers: If a few suppliers dominate the industry, they have the leverage to raise prices or dictate terms.

- Availability of substitutes: When there are few substitutes for the inputs suppliers provide, their bargaining power increases.

- Importance of the supplier’s product: If a supplier provides a critical component or resource, their power is high. For example, a unique, patented material or highly specialized technology.

- Switching costs: High switching costs (due to contract terms, quality control, or training) reduce a company’s ability to switch suppliers easily, increasing supplier power.

Strategic Action: To reduce supplier power, companies can diversify their supplier base, standardize input requirements, or explore backward vertical integration, where the company produces its own critical inputs.

5. Threat of Substitute Products or Services

The final pillar evaluates the extent to which different products or services can replace what your business offers. A high threat of substitutes can limit profitability, as customers may switch to alternative products that meet the same need.

Factors that Increase the Threat of Substitutes:

- Price-performance trade-off: Substitutes that offer a more attractive price-performance ratio can lure customers away.

- Availability of alternatives: When there are readily available alternatives (e.g., streaming services replacing cable TV), the threat of substitutes increases.

- Switching costs: Low switching costs allow customers to easily switch to substitutes without incurring any significant loss.

Strategic Action: To counter the threat of substitutes, companies must emphasize the unique value of their products, investing in innovation and research & development to ensure that their offerings continue to meet customer needs in ways substitutes cannot. Building strong brand loyalty is another strategy to keep customers from exploring alternatives.

Want to Map the Five Forces for Your Market?

How to Build the Five Forces Map in Minutes with MindMap AI

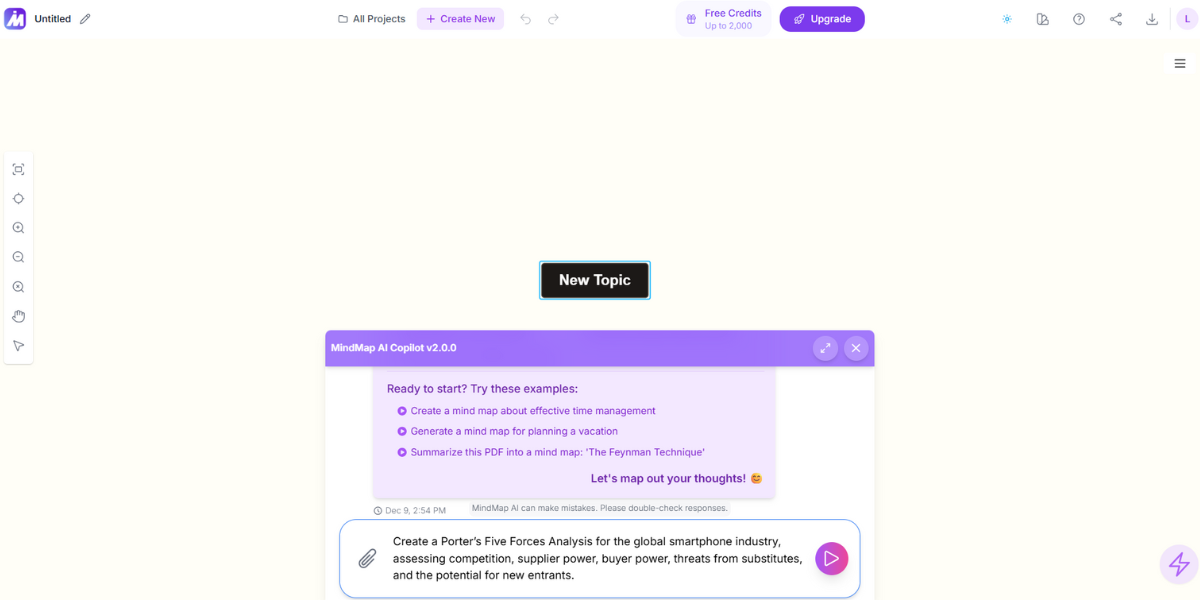

Step 1: Provide Your Context

Start by describing the industry or market you’re analyzing.

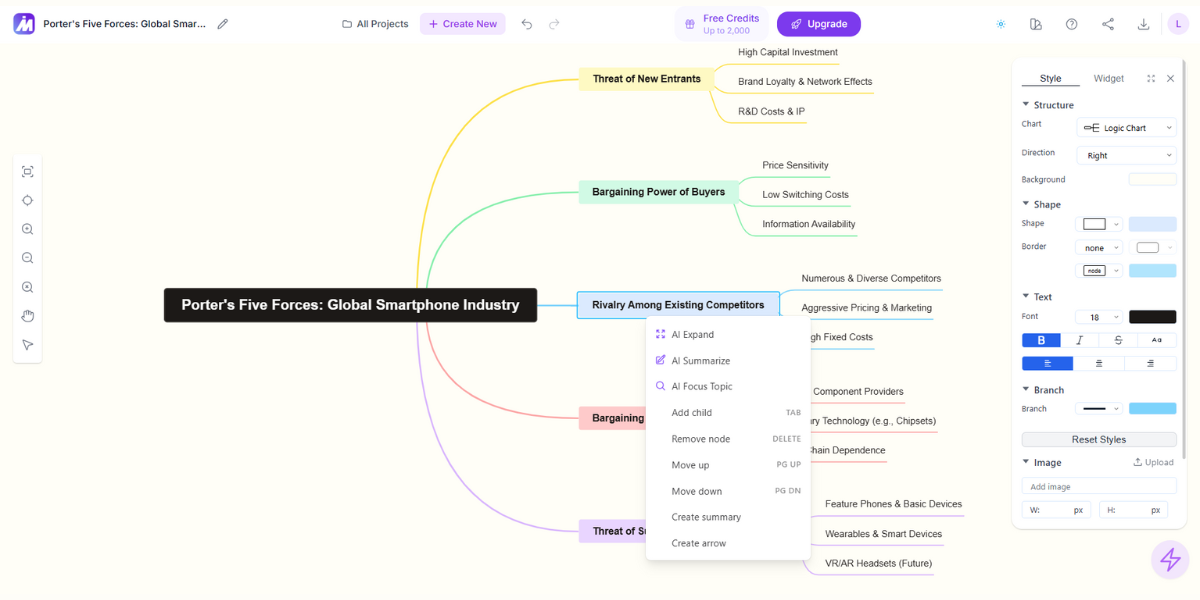

Example Prompt: "Create a Porter’s Five Forces Analysis for the global smartphone industry, assessing competition, supplier power, buyer power, threats from substitutes, and the potential for new entrants."

You can also upload industry reports, market data, or any relevant documents. MindMap AI will automatically extract key insights.

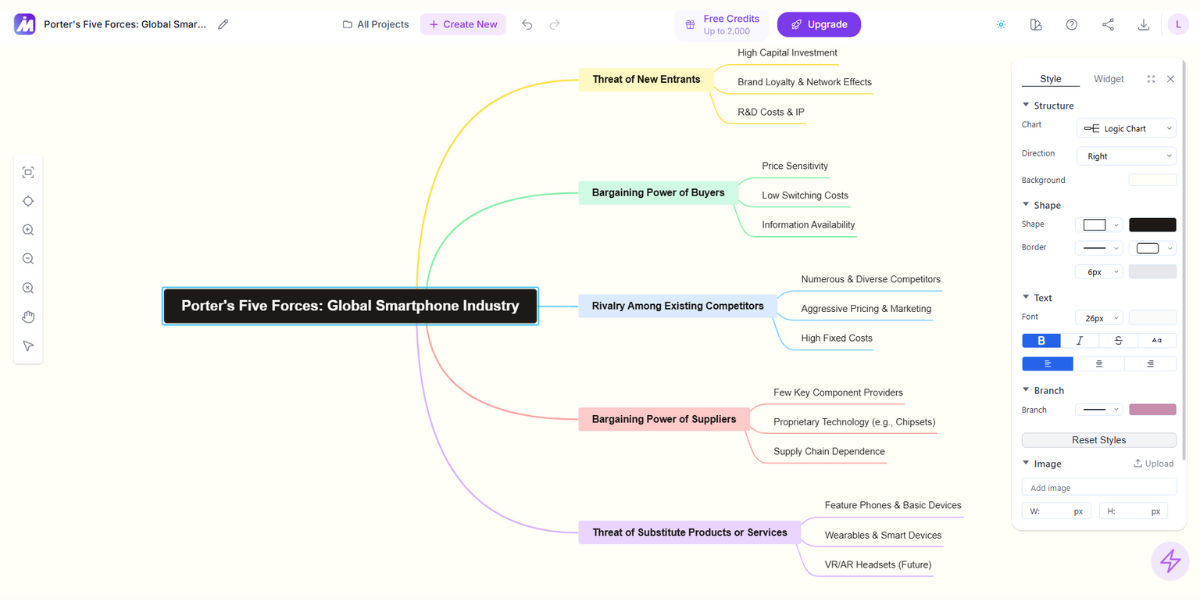

Step 2: Generate Your Five Forces Map

Once you’ve entered your context, MindMap AI instantly generates a visual Five Forces mind map, with each of the five forces as main branches.

Step 3: Refine and Expand Each Force

Click on each branch to expand and add more detailed information. For example:

- Under Bargaining Power of Suppliers, you might add sub-nodes like "few suppliers in the industry", "high switching costs", and "supplier concentration".

- Under Threat of Substitutes, you could add "availability of alternatives", "price-performance trade-off", and "consumer preference shifts".

You can also use Copilot Chat to:

- Summarize lengthy reports or documents,

- Expand points or ask for deeper analysis,

- Prioritize which factors are most relevant.

Step 4: Export and Share with Your Team

Once your Five Forces Map is complete, you can easily share it with your team for feedback and collaboration. Export the map in PNG, PDF, Markdown, or share a link for updates. Teams across different departments can view, comment, the map to stay aligned.

Porter's Five Forces: Your Strategic Blueprint for Success

Mastering this framework isn't just about identifying problems; it's about informing your competitive strategy . By deeply understanding the structure of your industry, you can:

- Identify Profitable Niches: Pinpoint segments where competitive forces are weaker.

- Shape the Forces: Take proactive steps (like product innovation or strategic alliances) to weaken supplier or buyer power.

- Guide Investment Decisions: Avoid industries that are inherently unattractive (high pressure across the board).

Porter's Five Forces analysis is more relevant than ever in today’s fast-changing digital economy. Use it not just as a one-off tool, but as a lens through which to constantly monitor and adapt your strategy. Ready to transform your business perspective? Start your Five Forces analysis today.

Putting It All Together

Mastering Porter’s Five Forces isn’t about listing problems, it’s about designing moves that reshape your playing field. When you visualize the forces and attach owners, KPIs, timelines, and risks, your analysis becomes a living plan that guides investment, product, and GTM choices.

Do You Ready to map your competitive environment?

FAQs

Q: What’s the main goal of Porter’s Five Forces?

To evaluate industry profitability potential by analyzing five structural forces that shape competition.

Q: How often should we run a Five Forces analysis?

Quarterly for dynamic markets; semi-annually for stable ones, or whenever a major shock (regulation, technology, consolidation) occurs. If the market shifts, you can run an updated map quickly to refresh assumptions and reprioritize actions.

Q: Is this useful for startups?

Yes. It clarifies where you can enter profitably (niches with weaker forces) and what moats to build early (switching costs, ecosystems).

Q: How does this differ from SWOT?

Five Forces analyzes industry structure (external). SWOT focuses on internal strengths/weaknesses plus external opportunities/threats. Many teams use both.

Q: How does MindMap AI help?

It turns text-heavy analysis into a visual, prioritized map with Action Plans, easy to share, update, and export.